Are you a crypto enthusiast navigating the wild world of digital currencies in South Africa? Congratulations on joining the financial revolution. But, hold on, before you get lost in the thrill of trading, there’s a critical challenge that might be draining the excitement out of your crypto journey: taxes.

Let’s face it, tax season is rarely anyone’s favorite time of the year. Now imagine trying to make sense of your crypto transactions, and calculate those gains and losses, all while keeping up with the ever-changing tax regulations in South Africa. Even experienced investors may find it challenging.

In this guide, we’ll walk you through the complexities of crypto taxes in South Africa and introduce you to your new best friend in the financial game – crypto tax software. So, whether you’re a crypto veteran or just dipping your toes into the decentralized waters, join us as we explore the top-notch crypto tax software designed to make your life easier.

What is Crypto Tax Software?

Crypto tax software is a tool that helps businesses and individuals calculate and file their taxes related to cryptocurrency transactions. These transactions can include buying and selling cryptocurrencies, rewards from stalking or mining crypto coins, receiving or paying for goods and services, and swapping one cryptocurrency with another.

A crypto tax software integrates with popular cryptocurrency exchanges and crypto wallets to automatically import transaction data and track portfolio performance. It then uses the same data to generate tax reports. Besides, good crypto tax software will show you a potential opportunity for tax optimizations, such as tax loss harvesting.

Why Do You Need Crypto Tax Software in South Africa?

With the increased popularity of cryptocurrencies across the world, tax authorities are increasingly looking for businesses and individuals who fail to accurately report their crypto-related income or gains.

Embracing the crypto tax software helps ensure compliance with the tax laws and avoid costly mistakes. Whether you are a crypto trader, miner, or simply an enthusiast, it’s essential to keep records of your crypto transactions and stay abreast of the latest tax laws regarding cryptocurrency.

How Does Crypto Tax Software Work?

Crypto tax software calculates your tax liability by analyzing all your cryptocurrency transactions. First, the software needs to import transaction data from the exchange, wallet, or directly from the blockchain. If an automatic import is not possible, you can manually add missing transactions or upload a spreadsheet.

In the next step, the software analyzes the transactions and categorizes them based on various factors like data, time, transaction type, cost basis, and fair market value.

With this foundation, the software can calculate gains and losses, and prepare tax reports.

5 Best Crypto Tax Software for South Africa

| Name | NFT Support | DeFi Support | Portfolio Tracking | Pricing |

|

Yes | Yes | Yes | From 49€ |

|

Limited | Limited | Yes | From 59€ |

|

Yes | Yes | No | From $65. |

|

Yes | Yes | No | From $49 |

|

Limited | Yes | No | From $49 |

- Blockpit

Established in 2017, Blockpit is one of the first companies that addresses crypto asset taxation while offering a top-notch solution for retail investors. It offers country-specific tax reports, pre-filled tax forms, and explanations for tax authorities. Besides, all Blockpit’s tax reports have been extensively audited by the KPMG.

Blockpit offers various crypto exchanges, wallets, and blockchains. This crypto tax solution adopts a sophisticated approach for the taxation of NFTs, DeFi protocols, staking, and mining.

A tax optimization feature of this solution highlights opportunities to reduce your tax liabilities within a tax year, such as tax loss harvesting.

Features

- Supports country-specific and compliant tax frameworks.

- Detailed NFT reporting.

- Optimize trades with tax-loss harvesting.

- Advanced tax reports.

- Detailed transaction overview.

- Supports thousands of cryptocurrencies, derivatives (incl. tokenized stocks), commodities, and hundreds of fiat currencies.

- Auto-labeling of transactions.

- Auto-matching of transfers and trades

Pricing

Per tax year:

- Free: Unlimited import, NFT support, and portfolio tracking without tax reports.

- Lite – 49€ – Tax reports for up to 50 transactions, everything in a Free plan, plus e-mail support.

- Basic – 99€ – Tax report for up to 1000 transactions, everything in Lite, plus tax optimization feature

- Pro – 249€ – Tax reports for up to 25,000+ transactions, everything in Basic plus advanced performance indicators.

- CoinTracker

CoinTrackers stands out because it provides a free option that includes tax reports, automatic synchronization with exchanges and wallets, and basic portfolio tracking for users with up to 25 transactions.

CoinTracker crypto tax software supports more than 300 exchanges and 8000 cryptocurrencies and can easily connect to platforms like TurboTax or TaxAct for the e-filing of your tax report in the US.

On top of that, it allows you to share your report with tax professionals for expert guidance. CoinTracker’s pricing is solely based on the number of transactions.

Features

- Automated portfolio tracking.

- Optimizes tax-based accounting methods.

- Instantly generate tax reports.

- Powerful client dashboard.

- Automatic error reconciliation.

- Customized tax treatment of transactions like staking and adding liquidity

Pricing

Per tax year:

- Free: Tax report for up to 25 transactions, cost basis and capital gains, error reconciliation, and tax pro collaboration.

- Hobbyist: 59€: Tax reports for up to 100 transactions, everything in Free Plan, plus 48 hours of product support.

- Premium: 199€: Tax reports for up to 1000 transactions, everything in Hobbyist, plus tax summary by wallet, priority product support, and 24-hour product support.

- Unlimited: 599€: Tax reports for unlimited transactions, everything in premium, plus custom features.

- TokenTax

TokenTax started back in 2017 and aims to make DeFi more accessible by providing a simple and straightforward solution for crypto taxes. The initial version from 2017 imports data directly from the Coinbase, and the basic plan today only supports Coinbase and Coinbase Pro accounts.

TokenTax’s crypto tax solution provides an intuitive interface and comes with a tax-loss harvesting feature. Their tax report supports FiFO, LiFO, and HiFO reporting methods, thereby providing partial support for the tax framework.

Transaction data can be imported directly from numerous exchanges via API key, uploaded manually, or uploaded via CSV file.

Features

- API and wallet integration.

- DeFi and NFT support.

- Margin and futures trading support.

- Easily find and fix errors or missing data.

- Tax loss harvesting dashboard.

- High transaction volume.

- Cross-chain transactions.

- All the traffic runs through the TLS encryption.

- Ethereum gas fee reports.

- Custom enterprise plans for traders with large volumes of unsupported or cross-chain transactions.

Pricing

Per tax year:

- Basic: $65: Tax reports for up to 500 transactions, live chat support, income report, IRS audit trial, transaction report, FiFO, LiFO, specific ID accounting, TurboTax online registrations.

- Premium: $199: Tax reports for up to 5,000 transactions, everything in Basic, plus DeFi and NFT support, manual imports for ICOs and OTC trades, tax loss harvesting dashboard, and automatic CSV imports for all exchanges.

- Pro: $1599: Tax reports for up to 20,000 transactions, everything in Premium, plus margins/options profit and loss calculation.

- VIP: $2,999: Tax reports for up to 30,000 CEX transactions, advanced crypto reconciliation, everything in Pro, plus review of IRS inquiries.

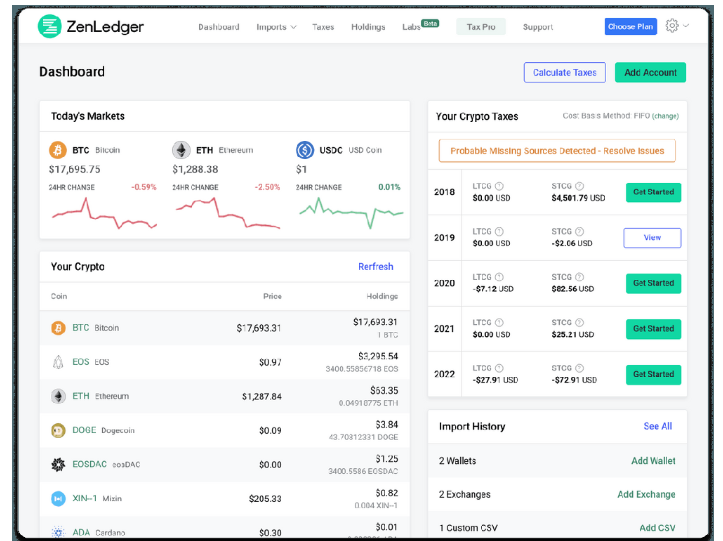

- ZenLedger

ZenLedger was established in 2017 and comes with a free trial version for up to 25 transactions, providing most features excluding support for DeFi, Staking, and NFTs.

The subscription plans vary between the Crypto Tax DIY Plans and Tax Professional Prepared Plans. Whereas the former are plans similar to those offered by other platforms, the latter are more costly alternatives that handle all the complexities of crypto taxes for you.

Features

- Offers a hassle-free solution and support for over 400+ exchanges, 100+ DeFi protocols, and 10+ NFT platforms.

- Uses cryptocurrency transaction history to generate IRS form 8949.

- Grand unified accounting.

- Mining and Staking income report.

- Supports the import of margin trading data from popular exchanges, such as Bitmex, Karaken, and Kucoin.

- Provides a comprehensive overview of all the taxable trades with relevant transaction data.

- Helps maintain compliance with the IRS.

Pricing

Per Tax Year:

Free: Tax reports for up to 25 transactions or less with all detailed reports.

Starter: $49: Tax reports for up to 100 transactions or less and all detailed reports.

Premium: $149: Tax reports for up to 5000 transactions or less and support DeFi/Staking/Margin trading.

Executive: $399: Tax reports for up to 15,000 transactions or less plus everything in Premium.

Platinum: $999: tax reports for unlimited transactions, everything in Executive plus 2 hours of premium support from a dedicated customer service agent.

- CoinLedger

CoinLedger was founded in 2018, with a primary focus on the US then expanded to other countries. It is now available for every country that is using FiFO, LiFO, HiFO, or ACB calculation methods.

CoinLedger’s crypto tax software comes with support for TurboTax, TaxAct, H&R Block Desktop, and TaxSlayer integration. The free license supports an unlimited number of transactions but no tax reports.

Besides, its interface is user-friendly and intuitive with lots of guides that help users import transactions from various exchanges, wallets, and blockchains.

Features

- Free portfolio tracking.

- Generate tax reports with the click of a button.

- Instantly calculates gains and losses for all transactions.

- Easily integrates with your favorite platforms.

- Tax reports can be directly imported into TurboTax Online, TurboTax Desktop, TaxAct, and other tax platforms.

- Generate crypto income, gains, and losses in any currency.

Pricing

- Free: Tax reports for unlimited transactions, portfolio tracking, support for unlimited exchanges, wallets, and 3000+ cryptocurrencies, capital gains overview, error reconciliation, and FIFI, LIFO, and adjusted cost.

- Hobbyist: $49: Tax reports for up to 100 transactions, everything in Basic, plus audit trial report, income report, tax loss harvesting, capital gains report, and IRS form 8949.

- Investor: $99: Tax reports for up to 1000 transactions, everything in Hobbyist, plus exchange API auto-sync, exchange CSV file import, wallet address auto-sync, and custom CSV file import.

- Unlimited: $199+: Tax reports for up to 3,000+ transactions, everything in Investor, plus popular tax software integrations.

Frequently Asked Questions

- How are cryptocurrencies taxed?

Cryptocurrencies are subject to taxes based on capital gains, where the profit from selling or trading crypto is taxed. Moreover, income from mining, staking, and other crypto activities can be taxed.

- Can tax authorities track crypto transactions?

Yes, tax authorities can track crypto transactions via blockchain analysis tools, cooperation with crypto exchanges, and legal measures. Blockchain’s transparency allows traceability of transactions, and authorities increasingly comply with methods to ensure tax compliance in the crypto space.

- How do I import crypto transactions into crypto tax software?

Most of the crypto transactions can be automatically imported by connecting your exchange or wallet with the crypto tax tool. This can happen via API keys or public keys.

Conclusion

Between trading, investing, staking, lending, or any other activity, there is the highest possibility that your crypto activities are subject to taxation, whether you are aware of it or not.

A good crypto tax software will save you time and money when submitting a tax report for your cryptocurrency incomes, gains, and losses to the concerned authorities. Make sure to pick a solution that complies with your local tax regulations and stays up to date with the recent developments and changes.