Designing a website for your fintech startup is not merely a matter of aesthetics—it’s about establishing trust, maintaining compliance, and turning visitors into long-time customers. Whatever you’re building—a digital wallet, loan platform, or investment app—your website is often where people first assess your credibility.

Check the simple checklist of features that must-have for each fintech startup in 2025 to create a safe-secure, user-friendly, and performance-pro website.

1. Homepage Clear Value Proposition

The homepage should always be able to answer for three questions below immediately:

- What exactly does your fintech startup do?

- For whom is it for?

- Why should anyone choose you?

Tip: You should keep your message clear and precise, and exact to the point, it should be short too. Use advantage-driven words and language like “Send money internationally in seconds” or “AI-powered money suggestion for small businesses.”

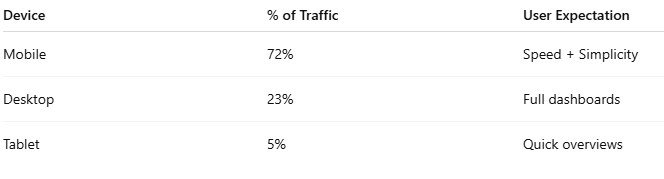

2. Responsively Designed & Mobile-First

A Total of 100% more than 65%-70% of user search and browse financial services over their mobile phones in the UAE, and all over the world.

Your fintech website must:

- Load speedily on all screen sets

- Use mobile-centric forms and CTAs

- Never use small fonts or screen-blocking pop-ups

📊 Table: Device Usage in Fintech Platforms

3. KYC flow shall:

- Be secure and fast;

- Engage ID upload, facial recognition (as needed);

- Inform users clearly about the process.

Bonus Tip: Use the services of third-party KYC API providers to develop faster.

4. Set SSL Security and HTTPS by Default

Are fintech sites that can afford to appear unsafe? Every page has to use HTTPS with a valid SSL certificate so as to provide protection for:

- User data

- Helping SEO (Google prefers secure websites)

- Giving trust to the user from the very first click

5. SEO Structure Makes It Work

Even fintechs need to be loved by Google. An optimally built website will pull users looking for your service.

Things to maintain:

- Proper title and meta tags

- Targeting keywords (“low interest business loan UAE”)

- Should load fast and not have broken links

Example keywords💡:

- “secure fintech platform UAE”

- “instant payment app Dubai”

- “AI personal finance assistant”

An SEO agency in Dubai would help most to tweak the strategy for the Gulf market, as it understands the language and regional intent.

6. Chatbots or Virtual Assistants Real-Time

Visitors often wonder about questions that they have before they even consider signing up. A well-trained AI chatbot can guide users, seize the opportunity to generate leads, and offer support 24/7.

Benefits of the chatbot:

- Decrease support cost

- Provide mult

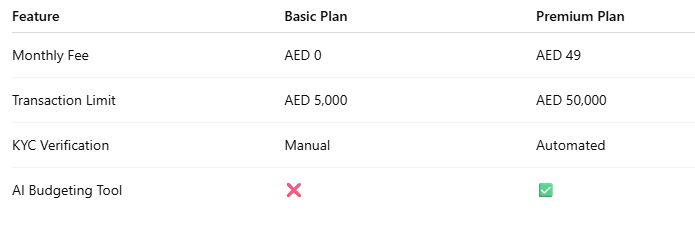

🧮 Comparison Table Example:

8. Easy-to-Use API Documentation (If B2B)

Developers need clear, well-explained docs if your fintech platform provides APIs (for payments, wallets, loans).

The API docs should have:

- The sample requests and responses

- API key management

- Giving access to the sandbox

- Security limitations and usage policy

Such a nice working environment will promote faster onboarding and help you retain more partnerships, especially as you plan to grow through the Middle East region.

9. Optimize Performance and Speed for SEO

Slow site means no converts. Bounced users drop your rankings in Google. Make sure that:

- Site loads under 2.5 seconds

- Images are compressed

- Codes are lightweight

- Hosting is secure and regional (e.g., UAE)

Fintech Speed Optimization Checklist:

- Lazy load images

- Compress CSS/JS

- Use CDN

- Avoid bloated plugins

For better results, cooperate with SEO services in Dubai who can seamlessly balance speed with optimization.

10. Regulatory Compliances and Legal Pages

The boring but important stuff should never be skipped. It spells professionalism and trust.

Pages required:

- Privacy Policy

- Terms & Conditions

- Cookies Policy (especially if targeting EU users)

- GDPR / PDPL Compliance (depending on the region of the user)

Also, show licensing info if you’re approved by UAE Central Bank or other authorities.

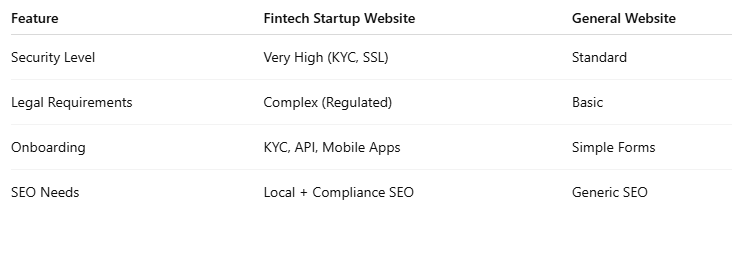

Bonus: What Makes Fintech Websites Different?

Unlike normal websites, fintech platforms deal with sensitive data, financial tools, and trust. Here’s how they differ:

Final Thoughts

Your fintech website is your foundation. It’s not just a place for visitors—it’s a place where trust is built, leads are converted, and users feel safe using financial tools. From mobile-friendly design to SEO to smart KYC flows, every detail matters.

If you’re launching in the UAE or targeting a Gulf audience, consider partnering with a trusted digital marketing company that understands fintech compliance, audience expectations, and fast-growing digital trends.

Comments are closed.