Many people wonder how to write a check in today’s digital world. Checks remain a simple way to pay for things like rent or bills. They provide a paper trail that cards sometimes lack. This article shows you the easy steps. You will learn to fill out each part right. We draw from trusted sources to keep info accurate. Let’s start with the basics.

What Is a Check and Why Use One?

A check is a paper slip from your bank. It tells the bank to pay money from your account to someone else. You write details on it, sign it, and give it away. The person cashes it or deposits it.

Checks started long ago. In ancient times, people used notes to promise payment. In the US, checks grew popular after the Federal Reserve Act in 1913. By the 1980s, Americans wrote about 16 billion checks each year. Now, that number has dropped to around 18 billion, making up just 5% of payments. But they still matter for big buys or when you need proof of payment.

Why use checks today? They work well for rent, gifts, or charity. Landlords often prefer them for records. Businesses use them for suppliers. Checks avoid fees that come with some apps. Plus, they feel secure if you handle them right. Stats show check fraud cost $815 million in scams like check washing last year. But with care, you stay safe.

Things You Need Before You Start

Gather these items first. This makes the process smooth.

- Checkbook: Your bank gives you this. It has blank checks and a register to track spending.

- Pen: Use blue or black ink. Skip pencil—it erases too easy.

- Payee info: Know the full name or company you pay.

- Amount: Decide how much. Check your balance to avoid overdraft.

- Memo details: Note why you pay, like “Rent for March.”

Make sure your account has enough money. Banks charge fees for bounced checks. Overdraft can cost $35 or more. Plan ahead.

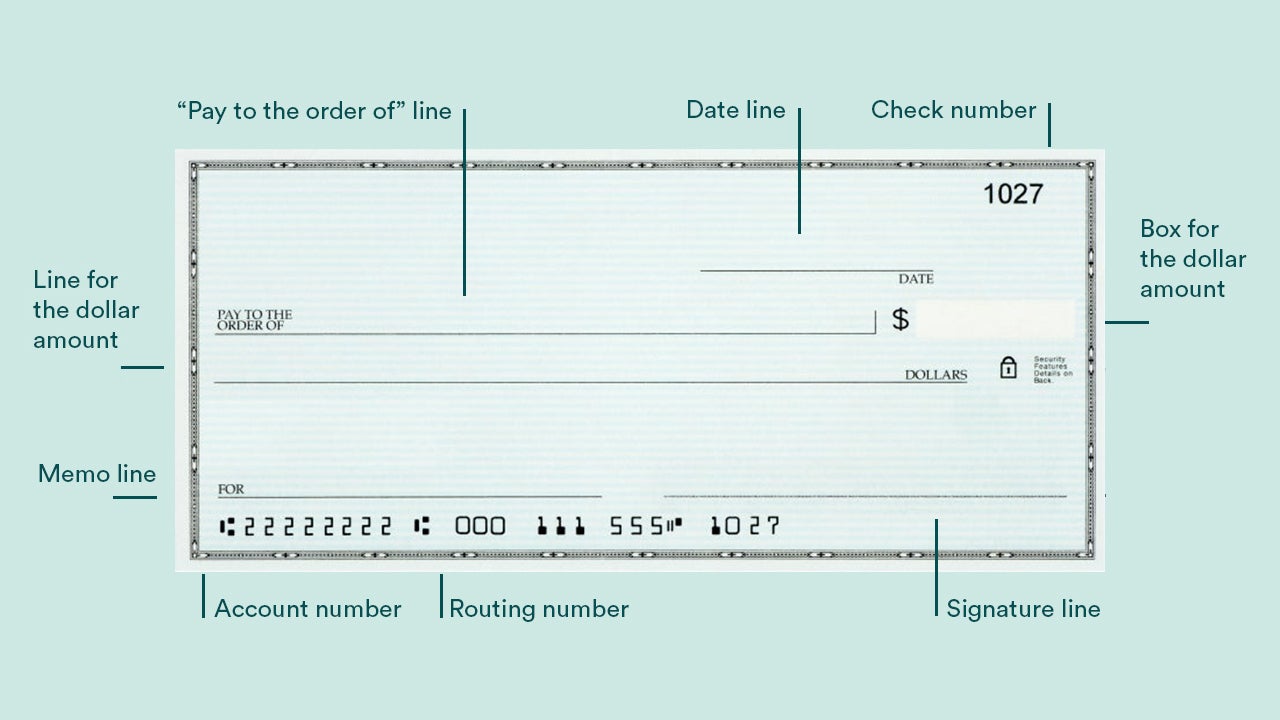

Step-by-Step: How to Write a Check

Follow these steps to fill out your check. Take your time. Double-check each part.

- Date the check. Put today’s date in the top right. Use MM/DD/YYYY format. For example, 02/08/2026. This shows when you wrote it. Banks may not cash old checks after six months.

- Name the payee. On the line that says “Pay to the Order of,” write the person’s or company’s name. Spell it right. If it’s cash, anyone can take it—risky if lost.

- Write the amount in numbers. In the small box with the $ sign, put the dollars and cents. Like $45.67. Use a decimal point. Keep it clear.

- Spell out the amount in words. Below the payee line, write it out. For $45.67, say “Forty-five and 67/100.” For whole dollars like $50, write “Fifty and 00/100.” Draw a line to the end to stop changes.

- Add a memo. In the bottom left, note the purpose. Like “Groceries” or “Account #1234.” This helps you and the payee remember.

- Sign it. In the bottom right, sign your name as it is on file at the bank. This approves the payment.

After, record it in your check register. Note the check number, date, payee, and amount. Subtract from your balance.

This method matches advice from banks. It cuts errors.

:max_bytes(150000):strip_icc()/how-to-write-cents-on-a-check-315355-final-5be57b294a9044788686c3f54cc35d2d.jpg)

Examples of Filled-Out Checks

See how it looks in real life. These show different cases.

For rent: Date: 02/01/2026. Payee: John Landlord. Numeric: $1,200.00. Words: One thousand two hundred and 00/100. Memo: February rent, Apt 3. Sign: Your name.

This keeps records clear for housing payments.

With cents for a bill: Date: 02/08/2026. Payee: Electric Company. Numeric: $82.45. Words: Eighty-two and 45/100. Memo: Account 56789. Sign: Your name.

Cents go as a fraction over 100.

To two people: Payee: Jane Doe or John Doe. This lets either cash it. Use “and” if both must sign.

Round amount gift: Numeric: $100.00. Words: One hundred and 00/100. Memo: Birthday gift.

Practice on scrap paper first.

Common Mistakes and How to Fix Them

Everyone slips up sometimes. Here’s how to avoid issues.

- Wrong amount: If numbers and words don’t match, banks use words. Write words first to match.

- Bad ink: Pencil or red ink? Banks may reject. Stick to blue or black.

- No signature: Forgot to sign? The check won’t work. Always sign last.

- Post-dating: Writing a future date? Banks might cash early. Use only if needed.

- Overdrawing: Not enough funds? It bounces. Check balance online.

If you mess up, void the check. Write “VOID” big across it in ink. Tear it up or keep for records. Don’t throw away—fraud risk.

Stats say mismatches cause many returns. Be careful.

Tips for Safe Check Writing

Stay secure with these ideas.

- Fill all spaces: Draw lines through empty spots. This stops crooks from adding words.

- Use secure mail: Don’t leave checks in open boxes. Use bank drop or inside post office.

- Track your checks: Review statements monthly. Spot odd charges fast.

- Order fraud-proof checks: Some have watermarks or special ink.

- Log everything: Use your register or app to match bank records.

Fraud like check washing—where thieves erase ink—hit $815 million last year. Permanent ink helps.

For businesses, checks aid efficiency. Learn more about accounting tips at Business to Mark.

How to Balance Your Checkbook

Keep track to avoid surprises.

- List all transactions: Checks, deposits, fees.

- Match to bank statement: Check off each item.

- Adjust for uncleared checks: Subtract or add as needed.

- Fix differences: Recheck math.

Do this monthly. It takes 10 minutes. Apps help too.

How to Reorder Checks

Running low? Contact your bank. Online or phone works. Cost $5-20 for a box. Choose designs if you want.

Or print at home with special paper—but banks must accept.

Alternatives to Writing Checks

Checks aren’t always best. Try these.

- Debit cards: Swipe and go. No paper.

- ACH transfers: Bank to bank online. Free often.

- Apps like Venmo: Quick for friends. But fees for some.

- Credit cards: Build rewards, but pay off fast.

Usage dropped from 50 billion checks in the 1990s to 18 billion now. Digital is rising.

For more on digital efficiency in finance, see this guide on accounting improvements.

FAQs About How to Write a Check

How to write a check with cents? Use decimal in numbers, fraction in words.

Can I write a check to myself? Yes, for moving money.

What if I make a mistake? Void it and start new.

How long is a check good? Usually six months.

How to endorse a check? Sign the back.

What is check washing? Thieves change details with chemicals.

How to deposit a check? Use app or ATM.

Can I post-date a check? Yes, but not always honored.

What if my check bounces? Pay fees and fix fast.

How to void a check for direct deposit? Write VOID, give to employer.

These cover common questions.

For detailed bank advice, check Huntington Bank’s guide. Or this comprehensive overview.

Conclusion

You now know how to write a check from start to end. Date it, name the payee, add amounts, memo, and sign. Avoid mistakes by checking twice. Use tips for safety. Balance your book and consider alternatives as needed. This skill helps manage money well. Have you written a check lately? Share your tips in comments.

References:

- “5 Ways Accounting Firms Improve Operational Efficiency” – Business to Mark. Covers efficiency in finance, useful for business users. Targets accounting pros seeking better workflows.

- “How to Write a Check” – Huntington Bank. Bank authority on basics, with steps and FAQs. Aimed at beginners and everyday bankers.

- “How to Write a Check: A Comprehensive Step-by-Step Guide” – Biz Reporterz. Detailed history, examples, and fraud info. For readers wanting in-depth insights.