Introduction

As of November 2025, Air Canada Stock (AC.TO), Canada’s largest airline, navigates a turbulent landscape marked by operational disruptions, fluctuating fuel prices, and shifting travel demand. With the stock trading at C$18.76, down 0.48% recently, investors are pondering if this dip represents a buying opportunity or a signal to wait. Year-to-date, the stock has declined 15.69%, underperforming the S&P/TSX Composite index’s 20.95% gain. This article delves into the stock’s forecast for 2025 and 2026, analyzing financials, risks, and analyst insights to help decide: buy now or hold off?

Current Stock Performance

Air Canada Stock has faced headwinds in 2025. The 52-week range spans C$12.69 to C$26.18, reflecting volatility. Over the past year, it returned -12.78%, while the three-year return is nearly flat at -0.05%. Beta of 1.73 indicates higher market sensitivity.

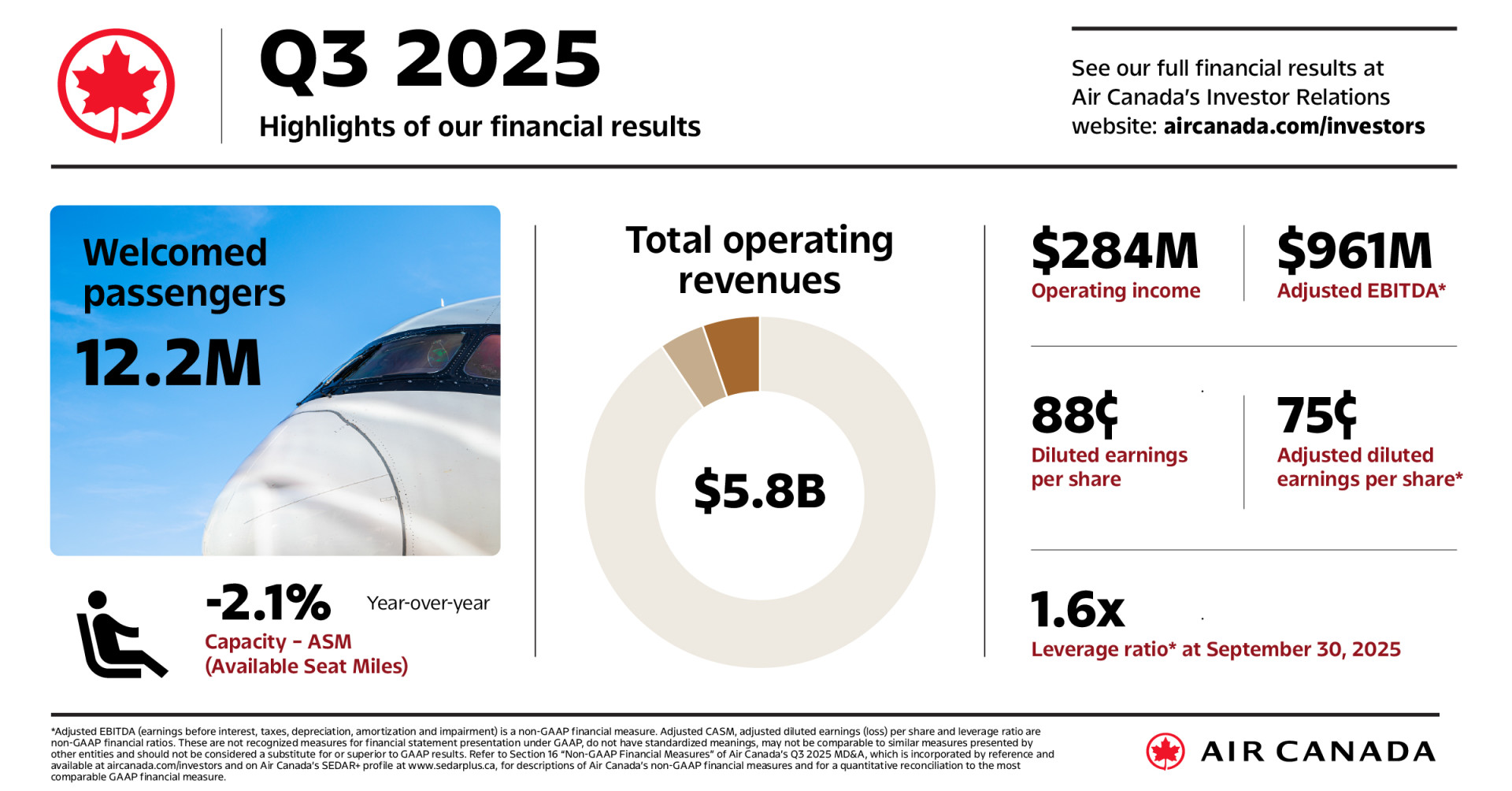

Recent Q3 2025 results showed total operating revenues of C$5.8 billion, a slight dip, with welcomed passengers at 12.2 million but capacity down 2.1% year-over-year due to pilot disruptions. Operating income was C$284 million, and adjusted EBITDA reached C$961 million. The leverage ratio stood at 1.6x as of September 30, 2025.

Financial Analysis

Trailing twelve months (TTM) revenue hit C$22.34 billion, with net income of C$1.48 billion and diluted EPS of C$3.95. Profit margin is 6.60%, return on equity an impressive 99.93%, but debt-to-equity is high at 659.99%. PE ratio is low at 4.75, suggesting undervaluation, with forward PE at 6.73.

Levered free cash flow TTM is C$491.88 million. However, the company revised its 2025 free cash flow guidance to C$0 to C$200 million from -C$50 million to C$150 million, citing flight suspensions’ impact. For 2026, outlook improves with modest capacity growth and expected yield recovery, potentially returning to positive free cash flow trends.

Industry Outlook and Market Trends

The airline sector grapples with post-pandemic recovery, supply chain issues, and economic uncertainties. Air Canada benefits from strong international demand but faces competition from low-cost carriers and rising costs. Fuel prices remain volatile, and labor disputes, like recent pilot strikes, have dented operations.

Globally, air travel is projected to grow, with IATA forecasting 5% annual passenger increase through 2026. In Canada, economic slowdowns could temper domestic demand, but tourism rebound supports transborder routes. Revenue estimates for 2025 hold steady, with 2026 projections slightly up to C$23.85 billion.

Risks and Opportunities

Key risks include operational disruptions, as seen in 2025’s flight impacts, geopolitical tensions affecting routes, and high debt levels amplifying interest rate sensitivity. Economic recession could reduce travel spending.

Opportunities lie in fleet modernization, loyalty program strength (Aeroplan), and expansion into cargo. With a market cap of C$5.555 billion, undervalued metrics could attract value investors. Positive 2026 outlook suggests recovery post-2025 constraints.

Analyst Forecasts

Consensus from 13 analysts is “Moderate Buy,” with 9 buy, 3 hold, and 1 sell ratings. Average 12-month price target: C$24.50, implying 30.60% upside. High target: C$32.00; low: C$12.00.

TradingView’s 13 analysts peg average at C$24.85, with max C$32.00 and min C$19.00. WalletInvestor forecasts 2025 closing around C$19.21, while Meyka sees bearish long-term to C$17.87 in 2026. StockScan (USD) predicts average $15.44 for 2025. Recent downgrades reflect caution, but overall sentiment leans positive for growth in 2026.

Conclusion: Buy or Wait?

Air Canada Stock 2025 looks challenging with revised lower free cash flow and operational hurdles, but 2026 forecasts clearer skies with improved yields and capacity. At current valuations, the stock appears undervalued, supported by moderate buy consensus and 30% upside potential. Risk-tolerant investors might buy now for long-term gains, while conservative ones could wait for Q4 results or economic clarity. Diversify and consult advisors before deciding.

Comments are closed.