In today’s fast-paced world, banking has become easier than ever. If you’re wondering how to endorse a check for mobile deposit, you’re in the right place. This process lets you skip trips to the bank and handle deposits right from your phone. It’s quick, safe, and convenient for busy people like you. We’ll break it down step by step, so you can do it right the first time.

Mobile check deposit turns your smartphone into a mini bank branch. You snap photos of the check, submit them through your bank’s app, and watch the money appear in your account. But proper endorsement is key. Without it, your deposit might get rejected, causing delays. Don’t worry – we’ll cover everything you need to know.

What Is Mobile Check Deposit?

Mobile check deposit is a feature in most banking apps that allows you to deposit checks using your phone’s camera. Instead of driving to an ATM or branch, you endorse the check, take clear pictures of both sides, and send them via the app. Banks process these deposits electronically, often making funds available within one business day.

This service started gaining popularity around 2010, when smartphones became common. It uses remote deposit capture technology, which banks first offered to businesses with scanners. Now, it’s available to everyone with a compatible app. Major banks like Bank of America and credit unions like EECU and Belco provide it as part of their digital services.

Why use it? It saves time and reduces the need for physical visits. For example, if you receive a paycheck or gift check, you can deposit it from home. Just ensure your app is up to date and your phone has a good camera.

The History of Check Endorsement and Mobile Deposit

Checks have been around for centuries, but endorsement rules evolved over time. In the 1800s, people signed checks to transfer ownership, preventing theft. By the 1900s, banks required signatures on the back for deposits.

Mobile deposit changed the game. It began in the early 2000s with business tools, but consumer versions launched after the Check 21 Act in 2004. This law allowed digital images of checks to replace paper ones, paving the way for apps.

In 2009, USAA became one of the first banks to offer mobile deposit to consumers. Others followed as smartphones improved. By 2012, apps like Chase and Wells Fargo included it. Endorsement requirements adapted too. In 2018, Regulation CC updates clarified rules for mobile deposits, requiring phrases like “For Mobile Deposit Only” to avoid duplicates.

Today, in 2026, mobile deposit is standard. Stats show its growth: In 2024, U.S. consumers made an average of 11 mobile payments per month, up from four in 2018. The remote deposit capture market is projected to reach USD 560.12 million by 2033, growing at 6.5% CAGR. This history shows how endorsement keeps deposits secure in a digital age.

Why Proper Endorsement Matters

Endorsing a check correctly protects you and the bank. It confirms you’re the rightful owner and intends the check for deposit. For mobile deposits, it prevents fraud, like someone cashing the same check twice.

Banks reject improperly endorsed checks to follow rules. A missing signature or phrase can delay your funds. Proper endorsement also helps if issues arise, like disputes over ownership.

Think of it as a safety lock. It reassures you that your money goes where it should. Plus, it complies with federal regs, keeping everything legal.

Step-by-Step: How to Endorse a Check for Mobile Deposit

Ready to learn how to endorse a check for mobile deposit? Follow these simple steps. We’ll use active voice to make it clear.

- Gather your materials. You need the check, a pen with dark ink, and your bank’s mobile app. Use blue or black ink – red or pencil might not scan well.

- Flip the check over. Look for the endorsement area. It’s usually the top 1.5 inches on the back, marked with lines.

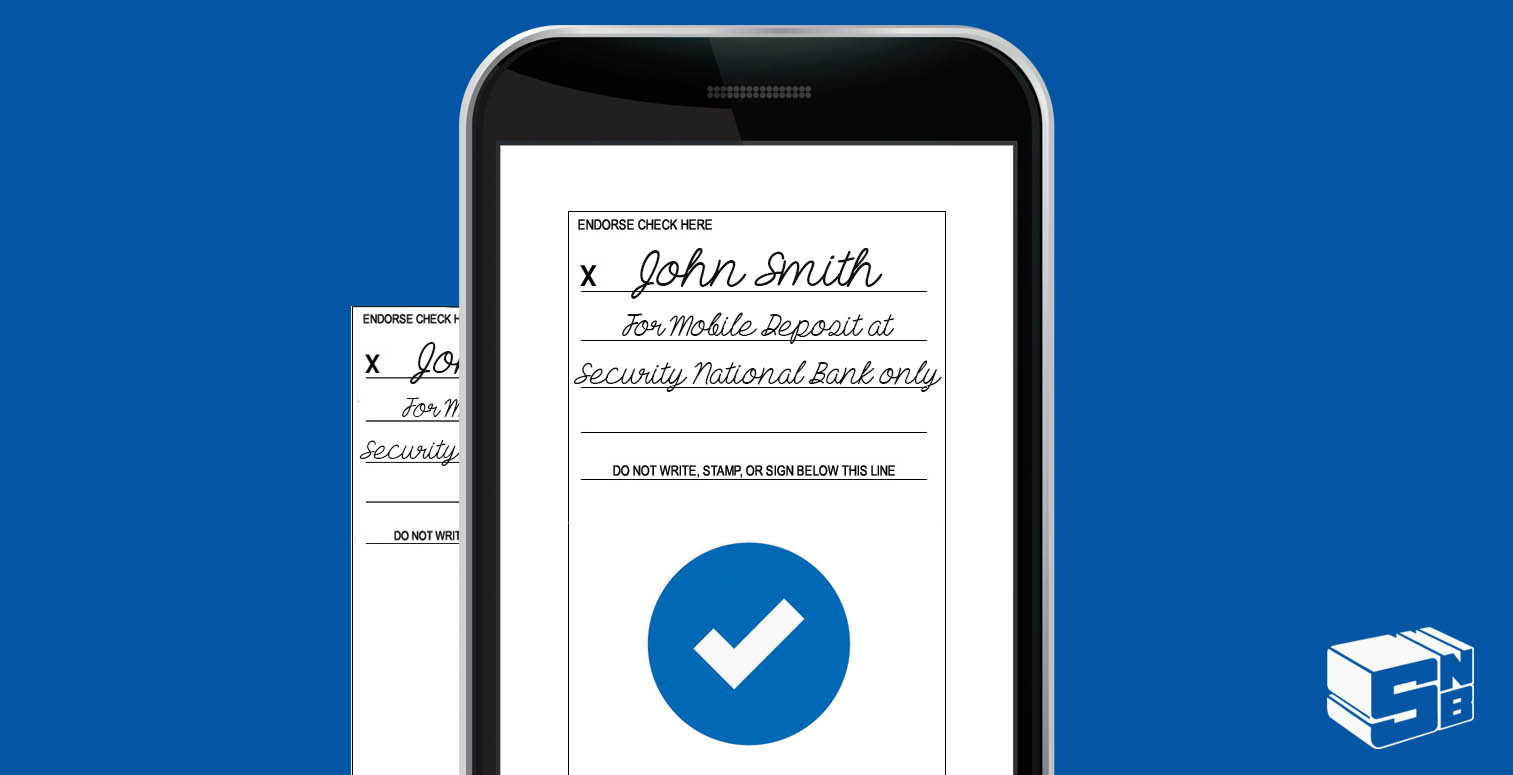

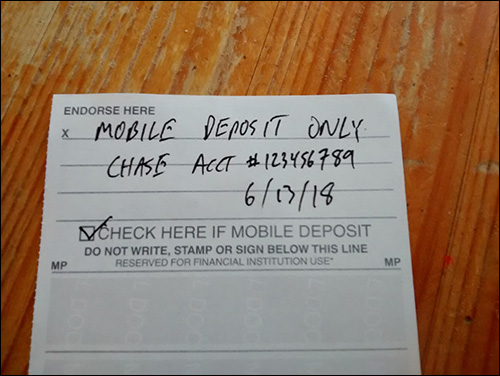

- Sign your name. Write your full name as it appears on the front. If it’s a joint check, both parties sign.

- Add the required phrase. Below your signature, write “For Mobile Deposit Only.” This is crucial – it restricts the check to app deposits. Some banks want their name too, like “For Mobile Deposit Only at [Bank Name].”

- Include extra details if needed. Check your bank’s rules. Some require your account number or date.

- Avoid extras. Don’t write anything else that could confuse the scanner, like doodles.

Now, deposit it:

- Open your app and select “Deposit Check.”

- Choose the account.

- Enter the amount.

- Snap photos: Front first, then back. Use good light on a dark surface.

- Submit and confirm.

That’s it! Funds often appear quickly.

Common Mistakes When Endorsing Checks for Mobile Deposit

Even pros make errors. Here are top slip-ups and fixes, based on expert advice.

- Forgetting to sign. Always sign – unsigned checks bounce. Fix: Double-check before snapping photos.

- Missing the restrictive phrase. Without “For Mobile Deposit Only,” banks might reject it. Fix: Make it a habit to add it.

- Poor photo quality. Blurry images lead to rejections. Fix: Use steady hands, good light, and a flat surface.

- Mismatched amounts. If numbers don’t match words on the check, it fails. Fix: Verify before endorsing.

- Not endorsing for the right bank. Some require their name in the phrase. Fix: Read app reminders.

- Depositing twice. Apps detect duplicates, but don’t try. Fix: Store checks safely for 60 days, then shred.

- Using the wrong ink. Light colors don’t scan. Fix: Stick to dark ink.

Avoiding these keeps deposits smooth.

Variations in Endorsement Requirements by Banks

Banks have slight differences in rules. For example, Bank of America requires “For Mobile Deposit Only” under your signature. EECU insists on handwriting it, even if preprinted. Belco wants “For Belco Mobile Deposit Only.”

Check your app or website. Regulation CC protects banks using restrictive endorsements, so most follow similar standards. Smaller credit unions might add account numbers.

Always review your bank’s policy. It prevents rejections and keeps you compliant.

Benefits of Using Mobile Check Deposit

Why switch to mobile? Here are key perks:

- Convenience. Deposit anytime, anywhere. No branch hours or lines.

- Speed. Funds available faster than mail or drives. Often next day.

- Cost savings. Free for most users. Saves gas and time.

- Security. Encrypted apps protect data. No lost checks.

- Ease for businesses. Small firms deposit low volumes without scanners.

Stats back it: 55% of U.S. consumers prefer mobile banking. It’s ideal for busy lives.

Security Tips for Mobile Check Deposit

Stay safe with these tips:

- Use official apps. Download from app stores, not links.

- Lock your phone. Use PIN, fingerprint, or face ID.

- Endorse restrictively. Always add “For Mobile Deposit Only.”

- Store checks securely. Keep for 60 days, then destroy.

- Monitor accounts. Check for odd activity daily.

- Avoid public Wi-Fi. Use secure networks for deposits.

- Beware scams. Don’t deposit checks from strangers.

Banks use encryption and fraud tools, but your habits matter.

Statistics on Mobile Check Deposit Usage

Mobile deposit is booming. In 2024, 34% used apps daily. By 2025, digital banking users hit 216.8 million in the U.S.

Younger folks lead: 18-24 year-olds use mobiles for 45% of payments. Check fraud affects 65% of banks, so proper endorsement is vital.

These numbers show its popularity and need for care.

Troubleshooting Common Issues

Deposit rejected? Here’s help:

- Blurry photo: Retake in better light.

- Endorsement error: Add phrase and resubmit if allowed.

- Amount mismatch: Confirm entry matches check.

- Limits exceeded: Check daily/monthly caps.

- App glitch: Update or restart phone.

Contact support if stuck. Most fix quickly.

Alternatives to Mobile Check Deposit

Not for you? Try:

- ATM deposits: Quick, but need card.

- Branch visits: Personal help.

- Mail-in: Slower, for remote areas.

- Direct deposit: Best for recurring payments.

Mobile is often fastest.

FAQs About How to Endorse a Check for Mobile Deposit

What if I forget the phrase? Your bank might reject it. Add it and try again.

Can I deposit any check? Most personal, business, government. No foreign or money orders.

How long to keep the check? 60 days, then shred.

Is it safe? Yes, with encryption.

What banks require extra? Check apps like Bank of America.

For more on banking, visit Business to Mark for tips.

:max_bytes(150000):strip_icc()/how-to-endorse-checks-315300-156cf43ec02848b9b6ac30864994d91a.jpg)

Conclusion

Mastering how to endorse a check for mobile deposit makes banking simple and stress-free. Sign, add the phrase, snap photos – done. It saves time, boosts security, and fits your life. Remember steps, avoid mistakes, and stay vigilant.

What’s your next deposit? Share in comments or try it today!

References

- EECU Guide – Details new rules and tips.

- Belco Guide – Step-by-step app use.

- Bank of America Info – Photo tips and limits.

Audience: Busy adults, small business owners, young users in urban areas like Faisalabad, seeking quick banking solutions.