The cost of goods sold formula is essential for tracking profitability and managing inventory effectively. Whether you’re a small business owner, an accountant, or an entrepreneur, grasping how to calculate COGS (Cost of Goods Sold) can make a significant difference in your financial decision-making. This article will dive deep into the cost of goods sold formula, explaining it step by step, providing real-world examples, and offering tips to avoid common pitfalls. By the end, you’ll be equipped to compute COGS with ease, helping you optimize operations and boost your bottom line.

What is Cost of Goods Sold (COGS)?

Cost of Goods Sold, often abbreviated as COGS, represents the direct costs attributable to the production or purchase of goods that a company sells during a specific period. It includes expenses like raw materials, labor directly involved in production, and manufacturing overheads, but excludes indirect costs such as marketing or administrative salaries. COGS is a key figure on the income statement, subtracted from revenue to determine gross profit.

Why is COGS important? It directly impacts your gross margin and overall profitability. For instance, if your COGS is too high relative to sales, it could signal inefficiencies in production or purchasing. Businesses in retail, manufacturing, and e-commerce particularly rely on accurate COGS calculations to price products competitively and manage cash flow. According to financial experts, monitoring COGS helps in tax deductions, as it’s an allowable expense in most jurisdictions.

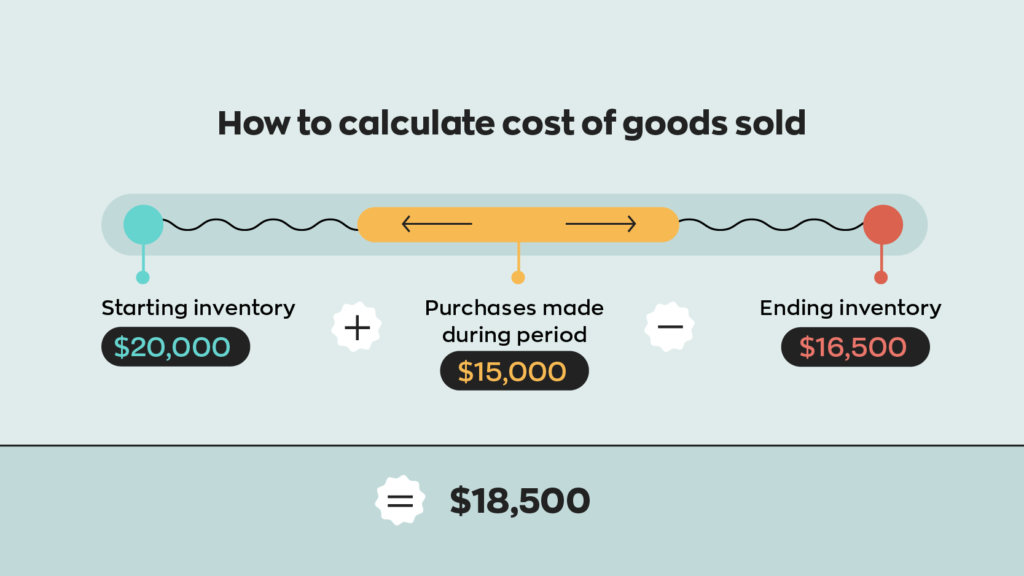

The cost of goods sold formula is straightforward yet powerful. It’s typically expressed as:

COGS = Beginning Inventory + Purchases – Ending Inventory

This equation captures the flow of inventory over a period, ensuring that only the costs of goods actually sold are accounted for.

Breaking Down the Cost of Goods Sold Formula

Let’s dissect the components of the cost of goods sold formula to make it crystal clear.

- Beginning Inventory: This is the value of your inventory at the start of the accounting period. It includes all unsold goods from the previous period, valued at cost (not retail price). For example, if you started the year with $50,000 worth of stock, that’s your beginning inventory.

- Purchases: These are the additional costs incurred to acquire or produce more goods during the period. This might include raw materials, supplier invoices, freight charges, and direct labor. If you bought $30,000 in materials, that’s added here.

- Ending Inventory: The value of unsold goods at the end of the period. This is subtracted because these items haven’t been sold yet and shouldn’t be expensed as COGS. If you end with $20,000 in stock, deduct that.

Plugging these into the cost of goods sold formula gives you the total cost of items sold. This method assumes a periodic inventory system, where physical counts are done at intervals. For perpetual systems, software tracks inventory in real-time, but the underlying formula remains similar.

How to Calculate COGS Step by Step

Calculating COGS using the cost of goods sold formula is easier than it sounds. Follow these steps:

- Determine Your Beginning Inventory: Review your balance sheet or previous financial statements. Use consistent valuation methods like FIFO (First-In, First-Out), LIFO (Last-In, First-Out), or Weighted Average Cost to ensure accuracy.

- Track Purchases: Sum up all direct costs related to acquiring or producing goods. This includes invoices from suppliers, shipping fees, and any customs duties. Exclude returns or discounts.

- Conduct an Ending Inventory Count: At the period’s close, perform a physical inventory check or use software to value remaining stock.

- Apply the Formula: Add beginning inventory to purchases, then subtract ending inventory.

For example, suppose a clothing retailer starts with $100,000 in inventory, purchases $200,000 worth of apparel during the quarter, and ends with $150,000 unsold. The COGS would be $100,000 + $200,000 – $150,000 = $150,000. This means $150,000 was the cost of goods actually sold.

In manufacturing, the formula expands slightly to include cost of goods manufactured (COGM), which factors in direct labor and overheads: COGS = Beginning Finished Goods + COGM – Ending Finished Goods. Tools like accounting software (e.g., QuickBooks or Xero) can automate this, reducing errors.

Real-World Examples of COGS Calculation

To illustrate the cost of goods sold formula in action, consider a bakery. Beginning inventory: $10,000 (flour, sugar, etc.). Purchases: $25,000 (more ingredients and packaging). Ending inventory: $8,000. COGS = $10,000 + $25,000 – $8,000 = $27,000. If the bakery’s revenue was $50,000, gross profit is $23,000.

For an e-commerce store selling electronics: Beginning: $500,000. Purchases: $1,200,000. Ending: $600,000. COGS = $500,000 + $1,200,000 – $600,000 = $1,100,000. This highlights how inventory turnover affects COGS—faster sales mean higher COGS but potentially better profits if priced right.

In service-based businesses, COGS might include direct labor costs, adapting the formula accordingly.

The Importance of Accurate COGS in Business

Accurately calculating COGS using the cost of goods sold formula is crucial for several reasons. It affects tax liabilities, as COGS is deductible, lowering taxable income. It also informs pricing strategies—if COGS rises due to supplier price hikes, you may need to adjust retail prices.

Moreover, COGS analysis reveals operational efficiencies. High COGS might indicate waste in production or poor supplier negotiations. Benchmarking against industry averages (e.g., retail COGS often 40-60% of revenue) helps gauge performance. Investors scrutinize COGS trends to assess scalability.

Common mistakes include miscounting inventory, ignoring indirect costs, or inconsistent valuation methods, which can lead to IRS audits or misguided decisions. Use audits and software to mitigate these.

FAQ

What is the basic cost of goods sold formula?

The basic cost of goods sold formula is Beginning Inventory + Purchases – Ending Inventory. This calculates the direct costs of sold items.

How does COGS differ for manufacturers vs. retailers?

For manufacturers, COGS includes raw materials, labor, and overheads via COGM. Retailers focus on purchase costs and inventory.

Can COGS be negative?

No, COGS can’t be negative. If calculations yield a negative, it likely means an error in inventory counts or data entry.

Why is ending inventory subtracted in the COGS formula?

Ending inventory is subtracted because it represents unsold goods, which shouldn’t be expensed as COGS in the current period.

How often should I calculate COGS?

Calculate COGS at least quarterly for financial reporting, but monthly for better management insights.

Additional Resources

For more in-depth reading:

- Wikipedia: Cost of Goods Sold

- Medium: Guide to Understanding Cost of Goods Sold (COGS)

- Medium: Cost of Goods Sold (COGS)

Comments are closed.