In this article, we delve into the world of student loan origination software, shedding light on the 10 essential features that set CompassWay apart in empowering lenders. These features not only streamline intricate processes but also elevate the borrower experience, ensuring a smooth and efficient journey from loan origination to repayment. Join us as we explore how CompassWay’s revolutionizes student lending, making it a trusted choice for institutions aiming to enhance operational efficiency and maintain compliance in the ever-evolving landscape of lending solutions.

- Comprehensive Application and Document Management:

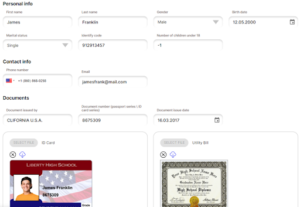

Efficient handling of student loan applications requires a robust system for managing application documents. Advanced document management tools integrated into the loan origination software streamline the application process, reducing errors and improving operational efficiency. By offering a seamless application experience with user-friendly interfaces and document upload capabilities, lenders can enhance the borrower’s journey while ensuring accurate data collection.

- Automated Eligibility Determination:

The ability to quickly and accurately assess borrower eligibility is paramount in expediting the loan approval process. By leveraging automated eligibility determination tools, lenders can evaluate applicant qualifications based on predefined criteria such as credit history, enrollment status, and financial need. This automation not only reduces processing time but also minimizes manual errors, providing a smoother experience for borrowers.

- Integrated Financial Aid Processing:

Today’s students rely on a variety of financial aid sources, including grants, scholarships, and personal funds, in addition to loans. A comprehensive loan origination software should seamlessly integrate with various financial aid systems to provide a holistic view of the student’s finances. By consolidating financial data from multiple sources, lenders can offer tailored loan solutions that complement existing aid packages, simplifying the borrowing process for students.

- Robust Compliance and Regulatory Support:

Navigating the regulatory landscape of student lending requires adherence to stringent compliance standards and data security measures. Loan origination software should feature built-in compliance modules, data encryption tools, and audit trails to ensure regulatory compliance and protect sensitive student information. By incorporating KYC (Know Your Customer) protocols and alternative credit checks, lenders can mitigate risks while maintaining regulatory compliance.

- Effective Loan Disbursement and Servicing:

Timely disbursement of loan funds is critical to meeting students’ financial needs and facilitating educational expenses. An automated disbursement system integrated into the loan origination software ensures prompt fund distribution according to predefined schedules or criteria. Additionally, self-servicing tools empower borrowers to manage their loans efficiently, with features such as online payment management and real-time account updates.

- Flexible Repayment Options:

Student borrowers require flexible repayment plans tailored to their financial circumstances post-graduation. Loan origination software should offer a variety of repayment options, including income-based plans, deferment, and forbearance, to accommodate diverse borrower needs. Customizable loan amounts based on actual cost of attendance and income levels further enhance borrower flexibility and reduce the risk of default.

- Dynamic Underwriting and Risk Assessment:

Assessing the creditworthiness of student borrowers requires sophisticated underwriting and risk assessment capabilities. Advanced algorithms integrated into the loan origination software can analyze credit history, income levels, and alternative data to determine risk profiles and set appropriate interest rates. By automating eligibility checks and credit decision-making processes, lenders can make informed lending decisions while minimizing manual review.

- User-Friendly Customer Onboarding:

A seamless onboarding experience is essential for attracting and retaining student borrowers. Loan origination software should feature intuitive interfaces, responsive design, and multi-channel support to accommodate diverse borrower preferences. Simplified navigation, automated updates, and dedicated customer support channels ensure a positive onboarding experience, fostering trust and satisfaction among borrowers.

- Borrower Self-Service Capabilities:

Empowering borrowers with self-service tools enhances their ability to manage loans independently and responsibly. A borrower portal integrated into the loan origination software enables borrowers to make payments, view transaction histories, and update personal information conveniently. By promoting borrower engagement and accountability, self-service capabilities contribute to improved loan management and repayment outcomes.

- Enhanced Data Analytics and Reporting:

Data-driven insights are invaluable for optimizing lending operations and improving decision-making processes. Loan origination software should include robust analytics and reporting features that provide lenders with actionable intelligence on loan performance, borrower behavior, and market trends. By leveraging predictive analytics and visualization tools, lenders can identify opportunities for process improvement and strategic growth initiatives.

Conclusion:

In an era of rising educational costs and evolving student financial needs, the importance of efficient and borrower-centric loan origination software cannot be overstated. By incorporating the 10 key features outlined in this article, financial institutions can streamline the lending process, enhance borrower experience, and stay ahead in the competitive landscape of student